The Leading Causes of Debt in Canada

Canada has some of the highest consumer debt in the world. With record-low interest rates, easy access to credit and a rising cost of living,

Canada has some of the highest consumer debt in the world. With record-low interest rates, easy access to credit and a rising cost of living,

Most people incorrectly assume that the cause of financial problems is living an overly lavish lifestyle, but this is simply not the truth. Oftentimes, people

A journey of a thousand miles begins with one step, and the journey to financial freedom is no different. When it comes to your personal

When it comes to your finances, have you ever sat and thought, “Where have I gone wrong?” It’s never too late to evaluate your financial

Looking for your first home? Unless you’ve got a lot of cash in the bank, you will probably need a mortgage. Unfortunately, getting a mortgage is

Many of us often wonder what exactly affects our credit score and by how much. If you’ve found yourself with a bad credit score, you may

Bad credit brings negative social, emotional, and financial stigma. If you have bad credit, you will find it very difficult to get a loan, meaning

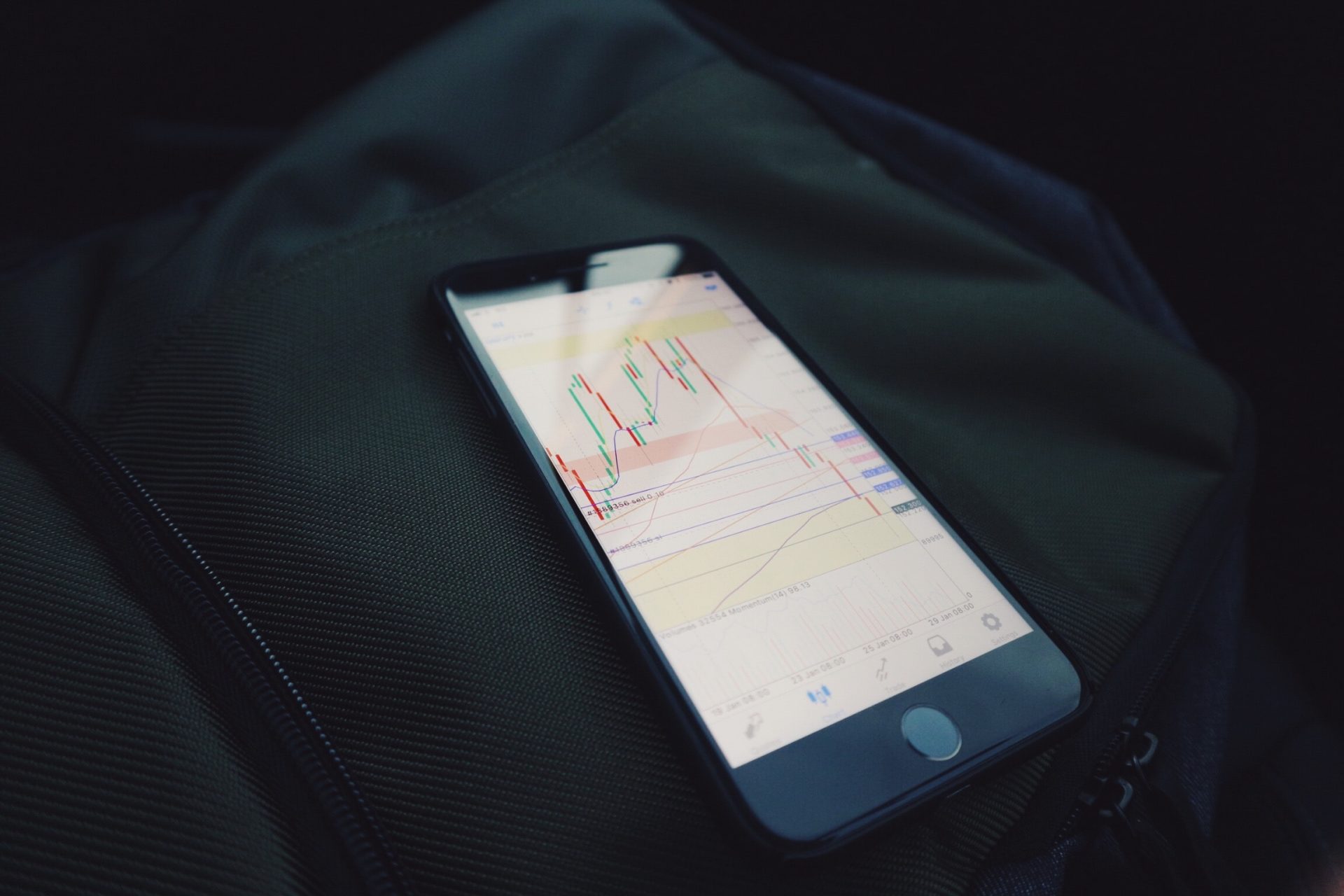

Canada’s recently released unemployment numbers show that the jobless rate jumped from 7.8 per cent in March to 13 per cent in April – nearly

Over the last few years, more and more families and individuals have been facing serious financial hardships, which have often stood in the way of

With today’s growing debt levels and the increasing cost of buying groceries, gas and other essentials, Canadians are looking for ways to make more money